The Carolina Casualty Difference

Carolina Casualty is dedicated to the trucking and public transportation industries. We have been delivering value through superior underwriting expertise and claim service for over 75 years. Our focus is to provide tailored transportation insurance solutions that fulfill evolving business needs by partnering with customers and effectively managing our mutual risk. Our aim is to do the right thing and we have found our greatest success with customers that value both long-term business relationships and mutual profitability.

You need a partner for the long haul and transportation insurance is our only business. We have been a leader with creative ideas and flexible nationwide coverages since 1943. Let us show you how easy protecting your transportation business can be.

Carolina Casualty Insurance Company is rated A+ (superior) by A.M. Best Company.

A trusted transportation insurance partner since 1943.

First dollar, retention, and deductible options for trucking and public auto.

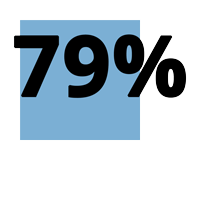

Seventy-nine percent of all physical damage and cargo claims have been closed in less than 90 days since 2012 and 53 percent have been closed in less than 30 days.

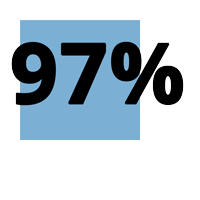

Since 2011, our claims staff has contacted more than ninety-seven percent of our insureds by phone or email within eight business hours of reporting a loss.

Carolina Casualty offers a full service, in-house claim administrator for our self-insured retention customers.